The average number of existing and new homes sold in the past 19 years is 5.2 million and 620,000, respectively. The chart below shows that the 4 million existing homes sold in 2023 were 20% below average:

Several key trends and challenges currently characterize the U.S. real estate market.

Higher Costs

The real estate market is not insulated from inflationary pressures. Runaway inflation forced the Federal Reserve Bank to raise interest rates, a major factor contributing to increased home prices costs, but there are other factors too:

- High interest rates – Interest rates play a crucial role in the real estate market, directly impacting home affordability. Over the past few years, the Federal Reserve’s monetary policy, aimed at controlling inflation, has led to a big spike in interest rates. In 2021, the average mortgage rate fell to a record low of 2.65%. Fannie Mae predicts mortgage rates will average 6.8% in the third quarter of 2024. That’s more than double 2021’s low.

- High home prices – The median price of a single-family home in June 2024 was $426,900, up 4% from a year earlier, the National Association of Realtors reports, the highest price ever recorded. That is nearly double the median home price in the U.S. in 2006, up 92%, at approximately $221,900. That was also the last year of the last housing bubble, which burst with disastrous effects during the Great Recession of 2007-09.

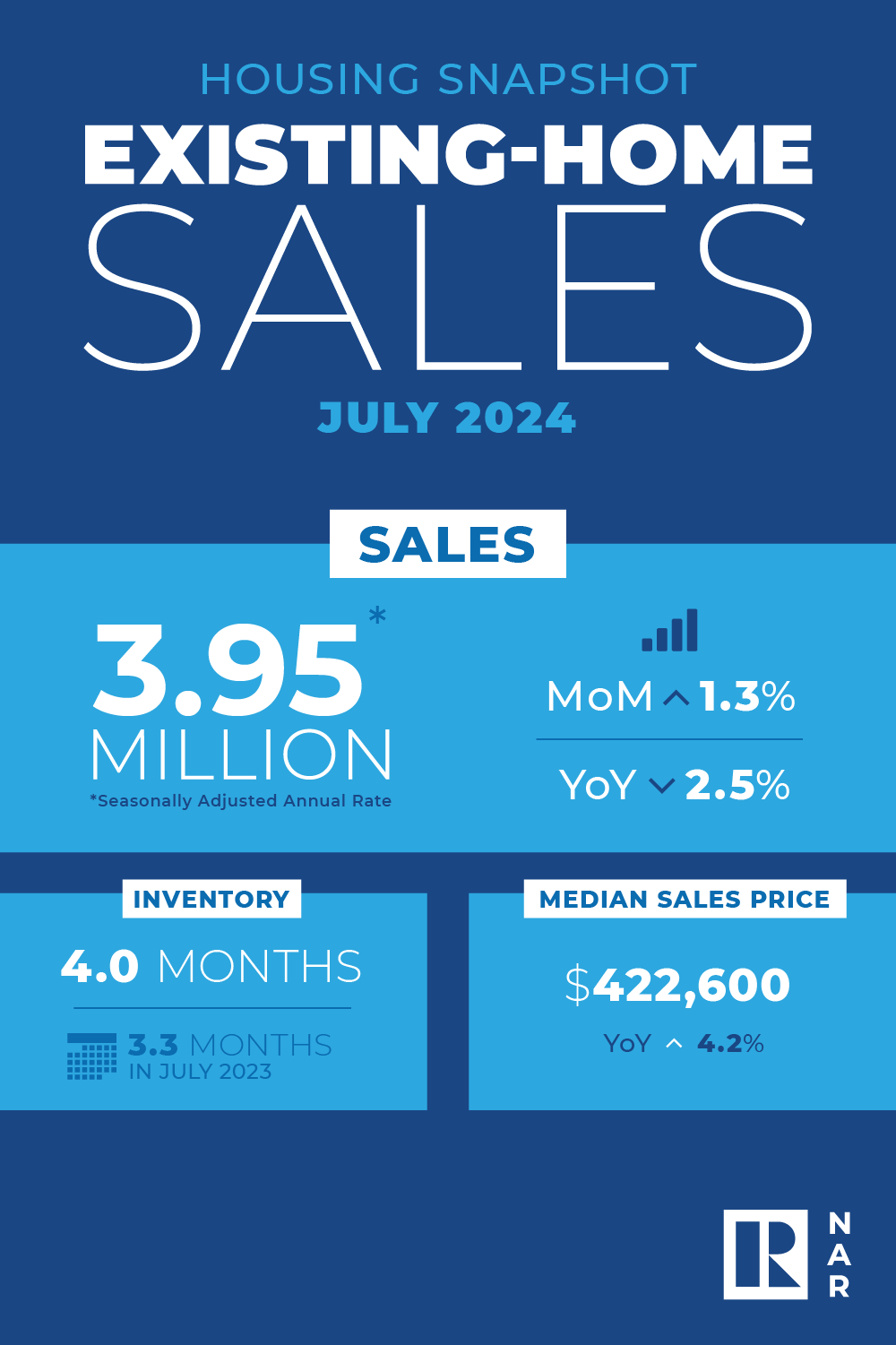

Existing-home sales housing snapshot: Home sales of 3.95 million reflect a seasonally adjusted annual sales rate; a median sales price of $422,600; and 4.0 months of inventory. The median sales price is up 4.2% year-over-year, and inventory was up nearly one month compared to July 2023.

Existing-home sales housing snapshot: Home sales of 3.95 million reflect a seasonally adjusted annual sales rate; a median sales price of $422,600; and 4.0 months of inventory. The median sales price is up 4.2% year-over-year, and inventory was up nearly one month compared to July 2023.

- Inflation – The higher home price situation is exacerbated because wages have not kept pace with the rising cost of living, leaving many potential buyers financially strained. Consequently, most of the population’s dream of homeownership remains out of reach.

- Increased closing costs – The Consumer Financial Protection Bureau reports that loan closing costs, like loan origination fees, discount points, appraisal and credit report fees, plus lender title insurance, rose almost 22% from 2021 to 2022.

Today’s high rates are not, by themselves, historically remarkable. In February 1980, the average 30-year mortgage rate was 12.85%, and still hovered around 8% in 2000.

Low Inventory

Compounding the issue of high interest rates is the persistent problem of low housing inventory. The supply of homes for sale has not kept up with growing demand, leading to a highly competitive market where buyers often find themselves in bidding wars. Several factors contribute to this low inventory:

- Limited new construction – The rate of new home construction has not recovered to pre-recession levels. Builders face numerous challenges, including high materials costs, labor shortages, and regulatory hurdles. This has led to a slower pace of new home builds, further straining the market. In 2005, the nation’s developers built 1.3 million new homes, nearly twice as many as in 2023, when 670,000 were constructed.

- Existing homeowners staying put – Many existing homeowners are reluctant to sell because they are locked into lower mortgage rates. About 70% of all mortgage holders have rates more than three percentage points below what the market would offer them if they tried to take out a new loan. The stay-put phenomenon is responsible for 1.3 million fewer home sales in America during the run-up in rates from the spring of 2022 through the end of 2023.

- Investor activity – Ironically, shows produced by the likes of HGTV, such as “Property Brothers’ or “Flip or Flop,” which were created to realize the dream of home ownership, have had the unintended effect of attracting a flood of institutional investors and small-time speculators. Investors purchase single-family homes to remodel and flip or convert properties into rentals. These investors typically outbid individual buyers by paying cash. In January 2024, 32% of home sales were made in cash, the highest rate since 2014, turning that homeowner dream into a feverish nightmare.

Rental Market

The rental real estate market has seen significant changes driven by economic factors and shifting demographics. Rising mortgage rates have pushed more people towards renting, leading to increased demand and higher rents. However, the market also faces challenges such as higher vacancy rates and a surge in new apartment constructions:

- Rising rents – Zillow reports that the median monthly rent in the U.S. in September 2024 stands at $2,100. According to Redfin, the pandemic caused a significant spike in the median monthly asking rent, rising 17% to a record high of $1,940 in March 2022. In 2022, Redin also reported that some areas, like Portland, OR, saw up to 40% year-over-year growth, with Austin, TX not far behind at 38%. There are many rent growth indices with strikingly different measurements of rent inflation, as this Federal Reserve Bank of Cleveland white paper suggests (PDF). Beginning with April 2020 data, Zillow released a new rental measure, the Zillow Observed Rent Index (ZORI), which measures changes in asking rents over time. As the Fed white paper suggests, ZORI is based on samples of mainly higher-tier detached rental units advertised in the Multiple Listing Service (MLS). However, since Zillow data is widely quoted and its research methodology well-documented, the chart below represents perhaps the best measure of rent growth facing new tenants. Using comparable April data of the past four years shows that since April 2020, rent in the U.S. has skyrocketed 31%:

- Higher vacancy rates – New apartment completions and economic slowdowns contribute to higher vacancy rates. In 2024, multifamily unit starts will fall to 379,000 total. Yet, despite this dip, approximately 1 million multifamily units are currently under construction, the highest level since 1973, according to the National Association of Home Builders.

- Diverse renter demographics – Renters now come from multiple age groups, seeking diversified living spaces.

- Suburban and single-family rentals – Both PwC and Buildium’s Industry Report point to the continued popularity of single-family rentals. According to the Industry Report, 68% of respondents lived in suburban or rural areas, which has steadily increased over the past five years.

Commercial Real Estate Market Trends 2024

The commercial real estate market in 2024 is navigating a landscape marked by both opportunities and challenges. Multifamily and neighborhood retail sectors continue to perform well, while the industrial sector shows signs of softening. The office market faces ongoing obstacles with rising vacancy rates, and the future of interest rates remains uncertain. Investors and operators are advised to optimize their liquidity and safeguard against fraud to capitalize on emerging opportunities.

- Multifamily and neighborhood retail – These sectors remain strong, with consistent demand and performance.

- Industrial sector – While still performing well, especially in cold-storage properties, the industrial sector shows signs of softening as post-pandemic demand decreases.

- Office space – The future of office buildings is uncertain. The national office vacancy rate reached 19.2% in Q3 2023, nearing historic peaks. There is a trend towards converting older office spaces into apartments or data centers.

- Interest rates – Higher-for-longer interest rates continue to influence the market, affecting loan maturities and investment activities.

- Retail real estate – Neighborhood shopping centers in urban and suburban areas are performing well, despite challenges faced by larger malls.

- Fraud protection – Commercial real estate owners and operators are increasingly focusing on safeguarding against fraud, especially in rent payment and check fraud.

- Workforce housing – Innovative approaches are being taken to increase the supply of workforce housing, beyond traditional financing methods.

These trends highlight the dynamic nature of the commercial real estate market, with varying performances across different sectors and ongoing challenges related to interest rates and office space utilization.

Zoning and Regulatory Constraints

Zoning laws and regulatory policies significantly impact the real estate market by controlling the type and density of housing that can be built in various areas. In many urban and suburban regions, restrictive zoning laws limit the development of multi-family units and higher-density housing, which could alleviate some of the pressure on housing supply.

These regulations, often rooted in preserving neighborhood character and preventing overdevelopment, inadvertently contribute to the scarcity of affordable housing options. A 2021 study found that the San Francisco “zoning tax” — the amount land prices are artificially inflated due to restrictive residential zoning laws — was estimated at more than $400,000 per home The median sale price of a home in San Francisco was $1.4 million in June 2024.

Moreover, the lengthy and complex permitting process for new construction projects adds to the cost and time required to bring new homes to market. Developers face significant bureaucratic hurdles, which can delay projects and increase expenses, ultimately leading to higher home prices.

Climate Change and Insurance Costs

Climate change is another critical factor affecting the real estate market. Increasingly frequent and severe weather events, such as hurricanes, floods, and wildfires, pose significant property risks. These risks lead to higher insurance premiums, making homeownership even more unaffordable.

In regions prone to natural disasters, the cost of insuring a home can be prohibitively high. Some areas have seen insurers withdraw coverage altogether, leaving homeowners with limited options and higher costs. This situation not only impacts the affordability of homes but also affects their resale value, as the high cost of insurance may deter potential buyers.

In Florida, which is experiencing stronger hurricanes due to climate change, the cost of homeowners insurance increased more than 40% on average in the past year. In 2023, the average annual rate was $10,996, and Insurify predicts a 7% increase to $11,759 in 2024. Some homeowners in South Florida have seen their premiums increase by as much as $500 per month.

The confluence of high interest rates, low housing inventory, restrictive zoning laws, and the increasing impact of climate change has created a challenging landscape for potential homeowners. The dream of owning a home with a white picket fence, while still cherished, is becoming increasingly elusive for many Americans.

Addressing these issues requires a multifaceted approach, including policy changes to encourage affordable housing development, incentives for sustainable building practices, and measures to mitigate the financial impacts of climate change. Only through concerted efforts can the barriers to homeownership be lowered, making the American dream more attainable for future generations.

Ubertrend: Generation X-tasy